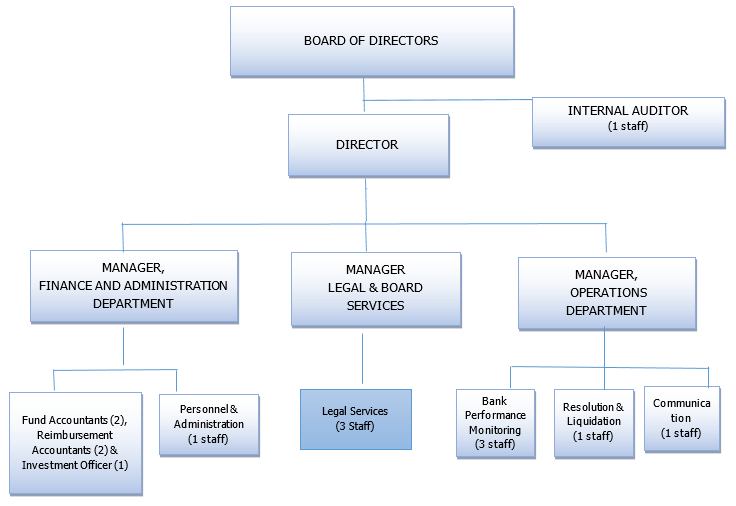

Welcome To the Deposit Insurance Board

The Deposit Insurance Board (DIB) which is responsible for policy formulation and management of the Deposit Insurance Fund (DIF) was established under the Banking and Financial Institution Act, 1991. Following the repeal of the Banking and Financial Institution Act, 1991, the DIB continued to operate under the Banking and Financial Institutions Act No. 5 of 2006. The operations of DIB started in 1994 under the auspices of the Bank of Tanzania (BOT).

The mandate of DIB is to provide protection to depositors’ money against loss arising from failure of a bank or deposit taking financial institution so as to maintain depositors’ confidence in the banking system. One of the core functions of DIB is to assess and collect premium from banks and deposit taking financial institutions and invest DIF resources. Currently, the premium assessment rate is 0.15 percent of the annual average total deposit liabilities of each entity and the maximum coverage is TZS 1.5 million per depositor per bank. Other functions include reimbursement of insured deposits and liquidation of failed banks or deposit taking financial institutions when appointed by the Bank of Tanzania.

The banking sector has experienced 11 failures of banking institutions since its liberalisation in 1991. The failed institutions are: Tanzania Housing Bank, Meridian Biao Bank (T) Ltd, Greenland Bank (T) Ltd, Delphi’s Bank (T) Ltd, FBME Bank Ltd, Mbinga Community Bank PLC, Njombe Community Bank Ltd, Meru Community Bank Ltd, Covenant Bank for Women Ltd, Kagera Farmers’ Cooperative Bank and Efatha Bank Ltd.

In line with its statutory functions, the mission statement of the DIB is as follows:

Our Mission

To contribute to the stability, integrity and public confidence in the nation’s financial system by providing protection to eligible deposits.

Our Vision

To be a reliable institution in promoting stability and public confidence in the financial system.

Our Core Values

- Integrity: We highly adhere to ethical standards in performing our duties and responsibilities in support of our mission.

- Accountability: We perform our duties transparently and remain accountable to our stakeholders.

- Communication we effectively communicate and collaborate with our stakeholders.

- Team work: We embrace multidisciplinary teamwork

- Excellence: We perform our duties professionally, embrace creativity and innovativeness in improving performance.